In 1988 as a mother of 5 active kids Julie Czoer worked at Lazuras in the Eastland Mall of Evansville. One day she was approached by a customer who was wanting some new shoes. When it was all said and done Julie had sold them 12 new pairs of shoes. The unsuspecting customer said she needed to sell real estate. That seed began to grow and sprout the start of Julie’s real estate career.

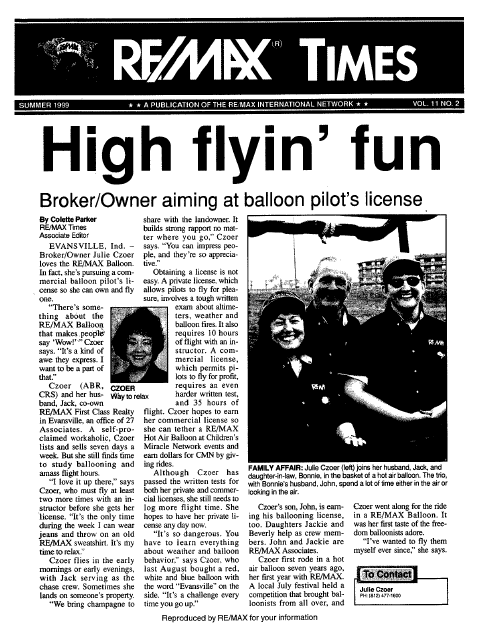

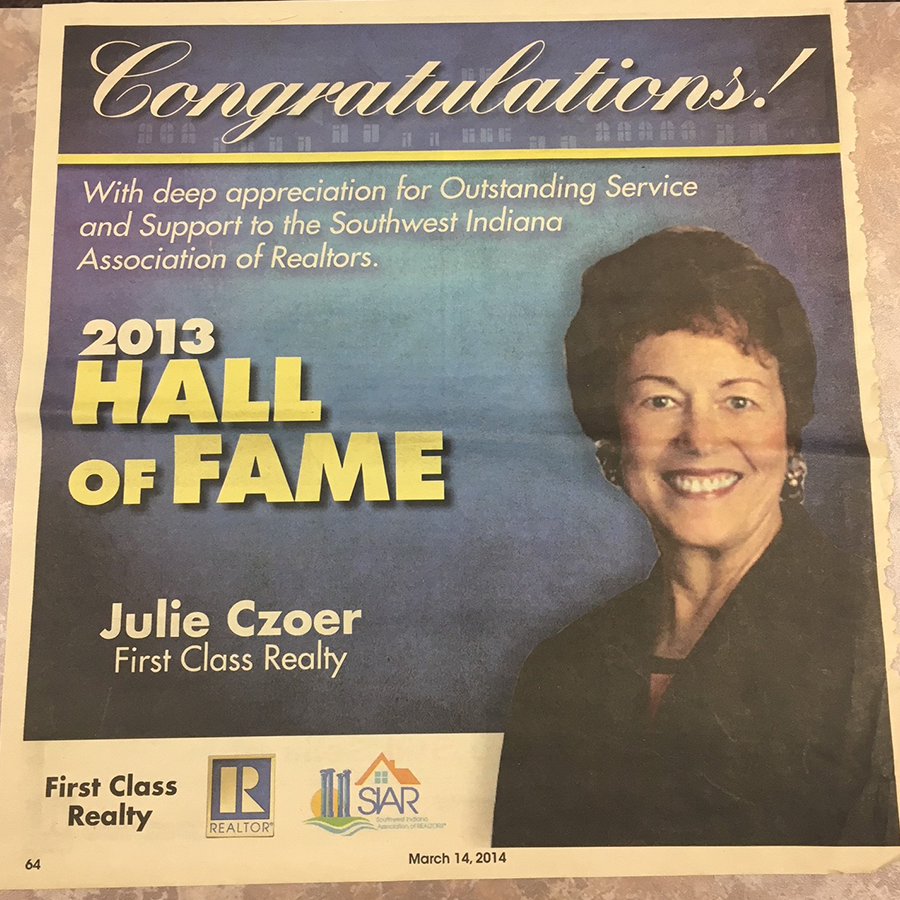

Julie earned her Real Estate Broker License in 1989 and opened the first RE/MAX franchise in Evansville in 1991. Julie’s husband Jack joined her team in 1990. Together Jack and Julie created a great realty group, taking Evansville by storm. In 1999 Julie was awarded Realtor of the Year by the Evansville Area Association of Realtors.

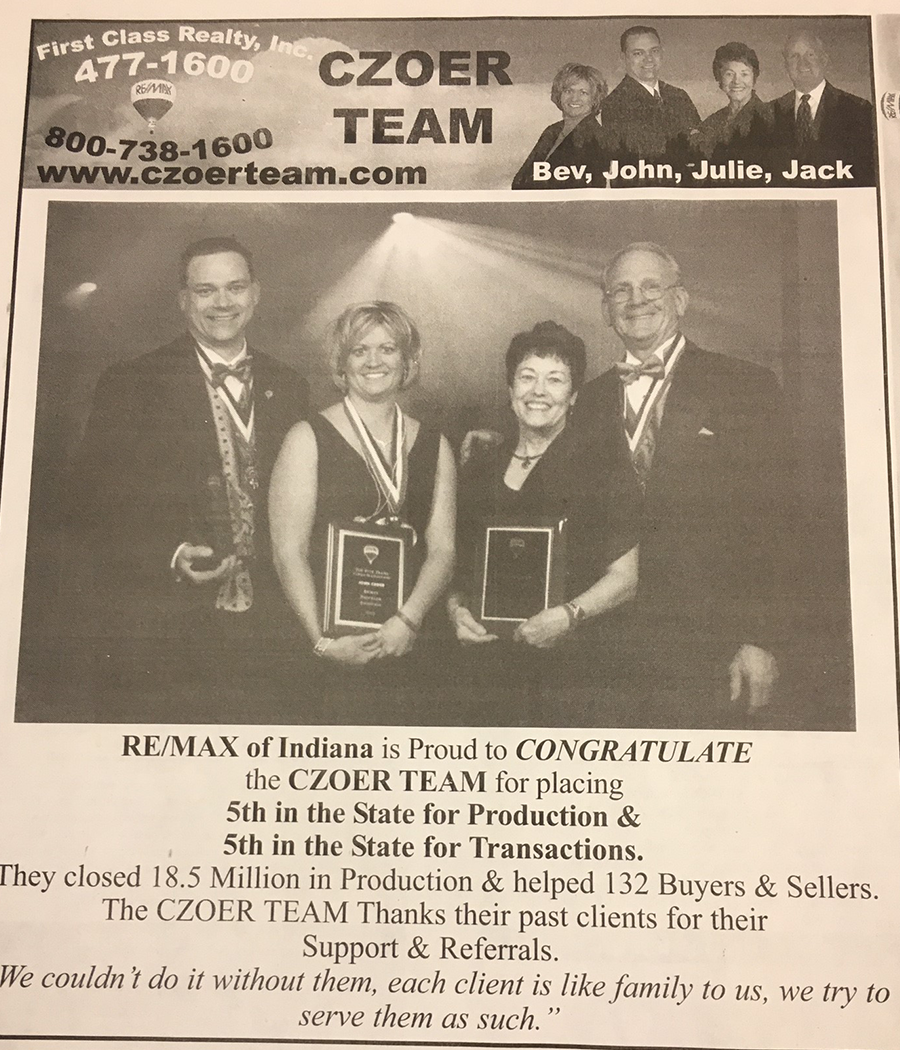

The youngest child of Czoers, John, joined the team in 1996 leaving his respiratory therapy career. Four years later Bev, Jack and Julie’s youngest daughter, joined the team leaving her dental hygiene career. In 1999 Jackie Crawford, the third child of the Czoer's, joined the office for 15 years. Her specialty was foreclosures and reposessions. As a family the Czoers headed a RE/MAX office of 43 agents.

In May of 2006 the Czoer team decided to become an independent company dropping the franchise and becoming First Class Realty.

As the years have come and gone the roles of the family members have changed. John and Bev have stepped up as the lead realtors of the team allowing Julie and Jack to step back and continue to be the support needed to keep this team going. Julie does the book keeping and scheduling of showings while Jack does negations, inspections, places signs and takes photos for listings. Czoer Team is not your typical realty group, when you buy or sell a home from Czoer Team you really do feel a part of their family.